Do you have a question?

Get in touch with me. Feel free to call me or send me an e-mail message. I look forward to the dialogue with you!

The Price Sensitivity Measurement (PSM) was developed by the Dutch economist Van Westendorp in 1976 and is most suitable for the determination of the price bracket of new products and services. Whilst the PSM can be used in early phases of product development in particular, to reveal price thresholds and to check whether there are enough potential buyers in the targeted price segment, it is somewhat less suitable for precise price recommendations.

The aim of the PSM is to use four questions to determine the acceptable price bracket and eventually to identify an optimum price. The four questions are as follows, with no adaptation for any specific product:

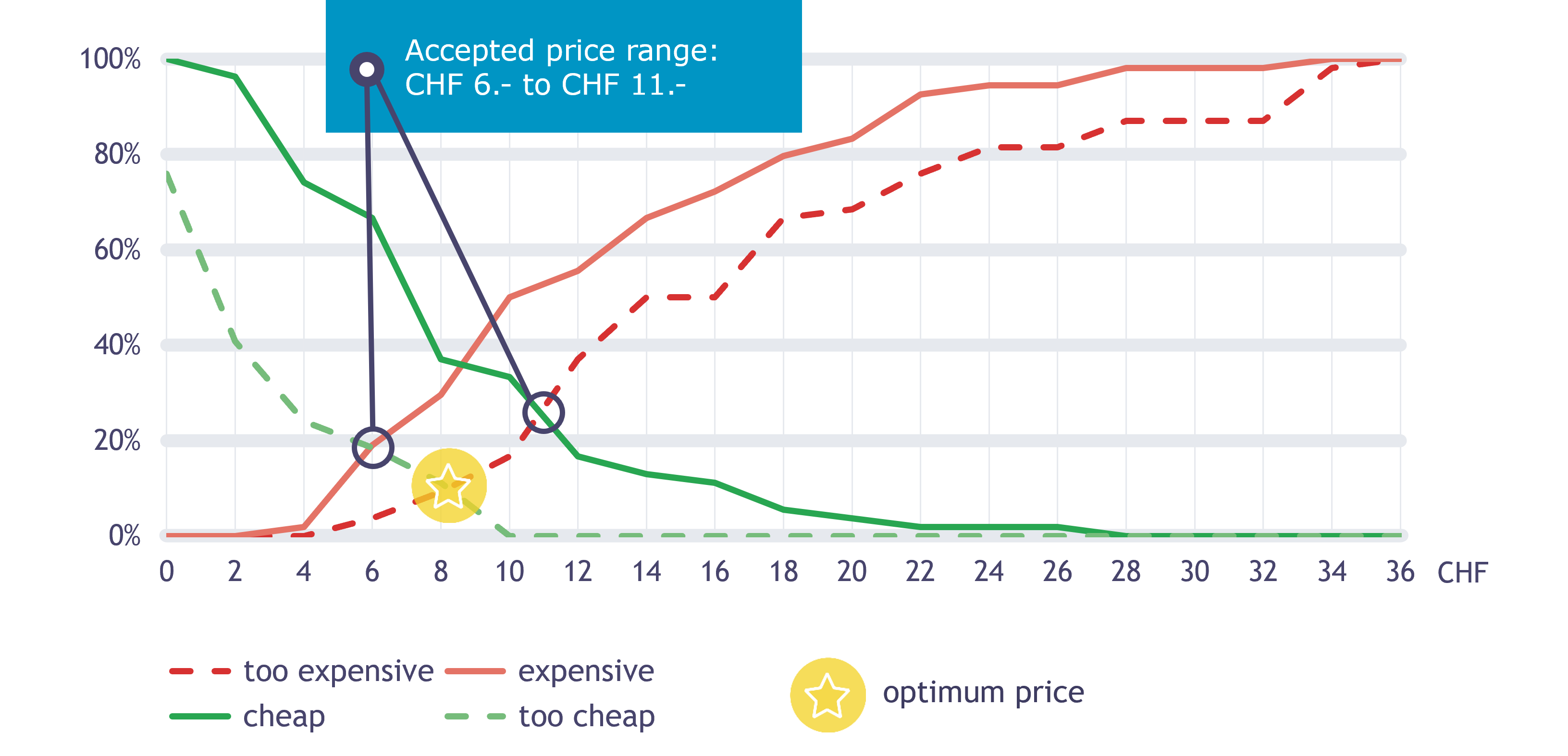

On the basis of the resulting intersecting points, four price points can be determined:

For the sample product, the optimum price is CHF 8.-.

Prices accepted by the respondents range from CHF 6.- to CHF 11.-.

Another field of application for price sensitivity measurements is the determination of price thresholds in the context of planned price increases. The basic idea here is that customers and non-customers of a company are asked at what price they would no longer be willing to buy a product/service.

However, the price thresholds determined in this way are not translated 1:1 into price recommendations, but intervista first carries out a risk assessment of the customers at each relevant price threshold.

This risk assessment is based on behavioural economic findings according to which it has been proven that customers have very different levels of price interest and price knowledge. As long as price knowledge and price interest are uncritical, price thresholds can in principle be exceeded without customers actually no longer buying the product. In this way, it is possible to better exploit price acceptance without negatively influencing other target variables such as conversion, satisfaction or NPS.

Get in touch with me. Feel free to call me or send me an e-mail message. I look forward to the dialogue with you!